Poland: This is the conclusion that Rynek Kolejowy made following an analysis of contracts for new passenger trains and locomotives signed in 2023.

The total value of 12 contracts was PLN 3.3 bln ($830 mln) excluding VAT. Rynek Kolejowy points out that this is a record volume in the modern history of the country’s railway transport, comparable to the volume reached in 2011.

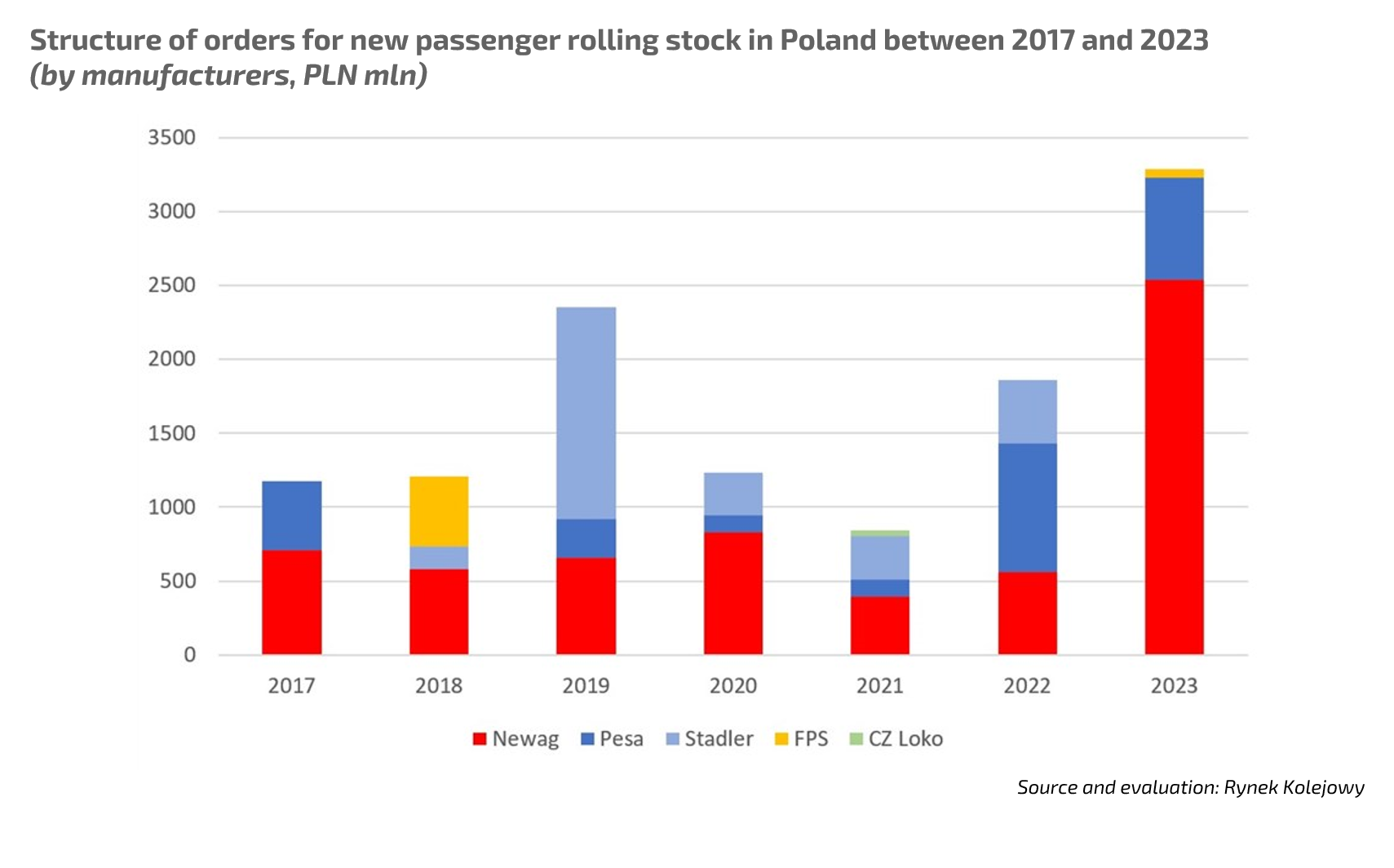

Structure of orders for new passenger rolling stock in Poland between 2017 and 2023 (enlarge). Source: Rynek Kolejowe

Structure of orders for new passenger rolling stock in Poland between 2017 and 2023 (enlarge). Source: Rynek Kolejowe

According to the media, last year, Polish operators placed orders for a total of 60 electric trains with varying numbers of cars, 6 hybrid trains and 71 passenger locomotives. Newag received 77% of the orders in terms of value, with the largest contracts being for 28 EMUs from Pomeranian Voivodeship and 46 electric locomotives from national operator PKP Intercity. Although Pesa’s share of the domestic market has decreased, the company is expanding its exports through contracts in Czechia, Israel, Romania and Ghana.

Newag continues fulfilling new major contracts on the domestic market. The company has won a tender for 26 EMUs for the regional Polish operator Koleje Slaskie and has been the only bidder for the supply of 35 hybrid trains for PKP Intercity. Now, it is also working on including several other small orders in its backlog of orders.

In 2024, the passenger rolling stock segment in the Polish market will undergo significant changes as its players plan to sign major firm contracts for 300 coaches to be delivered to PKP Intercity, with an option for 150 more, and for 200 EMUs to be delivered to another operator Polregio. Amidst these developments, Newag, the market leader, was accused of intentionally programming train failures to generate repair orders.