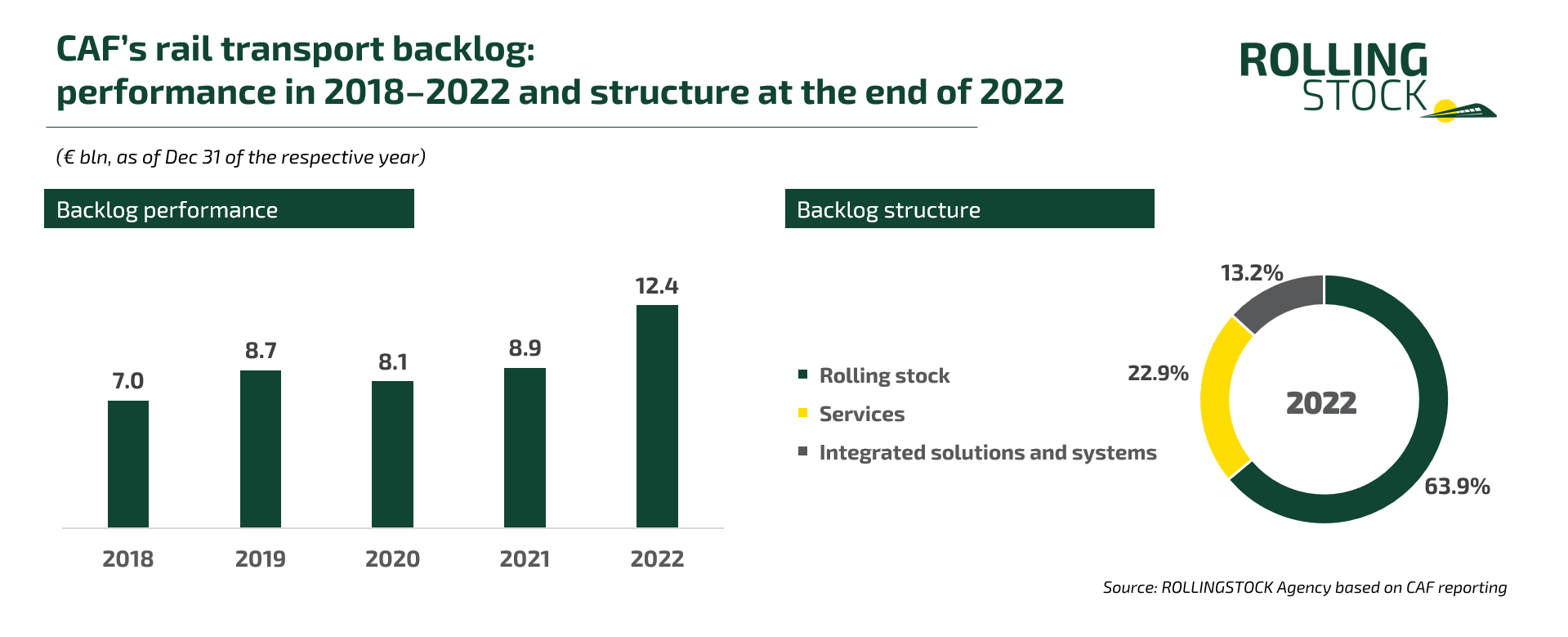

Recently, the Spanish manufacturer received the first orders for Coradia Polyvalent trains. CAF is expected to supply 11 four-car multiple units for the southwest France and seven four-car ones for Senegal. The company will manufacture the vehicles at its Reichshoffen plant acquired from Alstom, one of the major developments in the European market in 2022. Earlier, CAF reported record growth in its rail transport backlog last year which sky-rocketed by 39.7% compared to 2021 and reached €12.3 bln. As for the rest, the company has unveiled ambitious long-term plans while facing the challenges of an unfavourable economic environment and some issues in customer relationships.

At the end of 2022, CAF became the sixth member of a “club” of rolling stock manufacturers with a backlog exceeding €10 bln. Its members are already mentioned Alstom, Siemens Mobility, CRRC, Stadler, and Wabtec. However, many major manufacturers, for example, from Russia, do not disclose their figures in the reporting. Unlike other members, CAF is very much oriented toward foreign markets. In its home country, Spain, the company makes only 10% of its backlog while 56% of orders come from the European market, 14% from the American, 8% from the Asian-Pacific, and 12% from other markets.

CAF’s rail transport orders brought €5.3 bln in 2022, which is €2 bln or 79.2% more than in 2021. 67.4% of the orders account for rolling stock, 16.2% for services, and the same amount for integrated projects. It is worth noting that a high growth rate in orders was recorded before, too. In 2022, 78% of revenue came from rail transport and the remaining 22% from buses. The rail transport revenue of almost €2.5 bln grew by 11% compared to 2021 and is divided between rolling stock (57%) with more than 30 current projects and services and complex projects (43%).

(enlarge)

(enlarge)

The company significantly expands its presence in the global LRV market. According to SCI Verkehr, CAF (10%) was second only to Alstom (20%) in terms of global tram sales between 2020 and 2022. Alstom is a company that produces one of the world’s most popular Citadis trams and has acquired Bombardier Transportation whose Flexity trams are almost in high demand as Citadis. The largest LRV order CAF received in 2022 was for the supply of 102 seven-car low-floor trams to Boston for $811 mln. The second largest contract, €525 mln, was signed for the supply of 98 Urbos trams to Tel Aviv and their maintenance.

CAF has signed a number of major contracts for multiple units. A €600 mln contract for the supply of 30 four-car and 30 six-car double-deck Civity trains and their maintenance is one the most remarkable. The contract was signed with NS, the Dutch national rail operator. Another contract was secured with the Swedish state operator SJ: a $348 mln firm part for 25 five-car Civity EMUs and an option for up to 60 more. Renfe ordered 28 EMUs with batteries for €300 mln, with an option for 42 more. A $250 million firm contract with Etihad Rail for the supply of push-pull diesel trains became the way CAF used to enter the UAE market.

In his last November column, Aleksandr Polikarpov, Analysis and Consulting managing partner at ROLLINGSTOCK Agency, wrote about CAF’s potential to repeat the path of another fast-growing European company, Stadler, which also set new commercial records in 2022. The ambitious long-term development plan presented at the end of last year confirms the forecast. The company expects to receive €4.8 bln in revenues from all businesses and €300 mln EBIT in 2026. To achieve these targets, CAF will offer integrated transport solutions, a wider range of vehicles, and digital and green technologies. The company aims at the European, North American, and Asian-Pacific markets.

Economic conditions like inflation in the EU and disruption of component supply chains have not markedly affected CAF yet. It was only its net profits that reduced from €89 mln in 2021 to €55 mln in 2022. Among the latest adverse events, the company refers to energy prices that have grown by 250% from 2021, for example. To counteract this and other unfavourable conditions, CAF launched a price monitor centre for raw materials, declined related long-term obligations, and, in H2 2022, withdrew some contracts because of the lower-than-expected margin. To protect itself against troubles in supply chains, the company set up a special control centre and started building up the inventories of components.

This year, however, CAF has become the first European rolling stock producer to officially announce halting deliveries of rolling stock, namely, Urbos trams to Oslo, because of component shortage. At the start of the year, the company had to delay the delivery of narrow-gauge trains in Spain because of incorrect data in the technical specifications. Customer relations issues in other countries, such as the Philippines and Australia, have also been made public.