Spain: CAF has published a report on the financial results for 9 months of 2022. According to it, the company has reached an all-time high backlog of €11.9 bln. The highest development rates in recent years in Europe were shown by Stadler. CAF has the potential to go this way as well.

First of all, some figures from the report are to be mentioned. CAF ‘s revenue for 9 months was €2.2 bln that is 8% higher than a year before and amounts to nearly all of last year’s total revenue. The EBITDA margin stands at 7.2% (-1.4 p.p.). Over the past period the company also received new orders for €3.8 bln, €3.15 bln of which for railway transport. For comparison, the Spanish manufacturer received €3 bln orders in the rail segment for the whole of 2021.

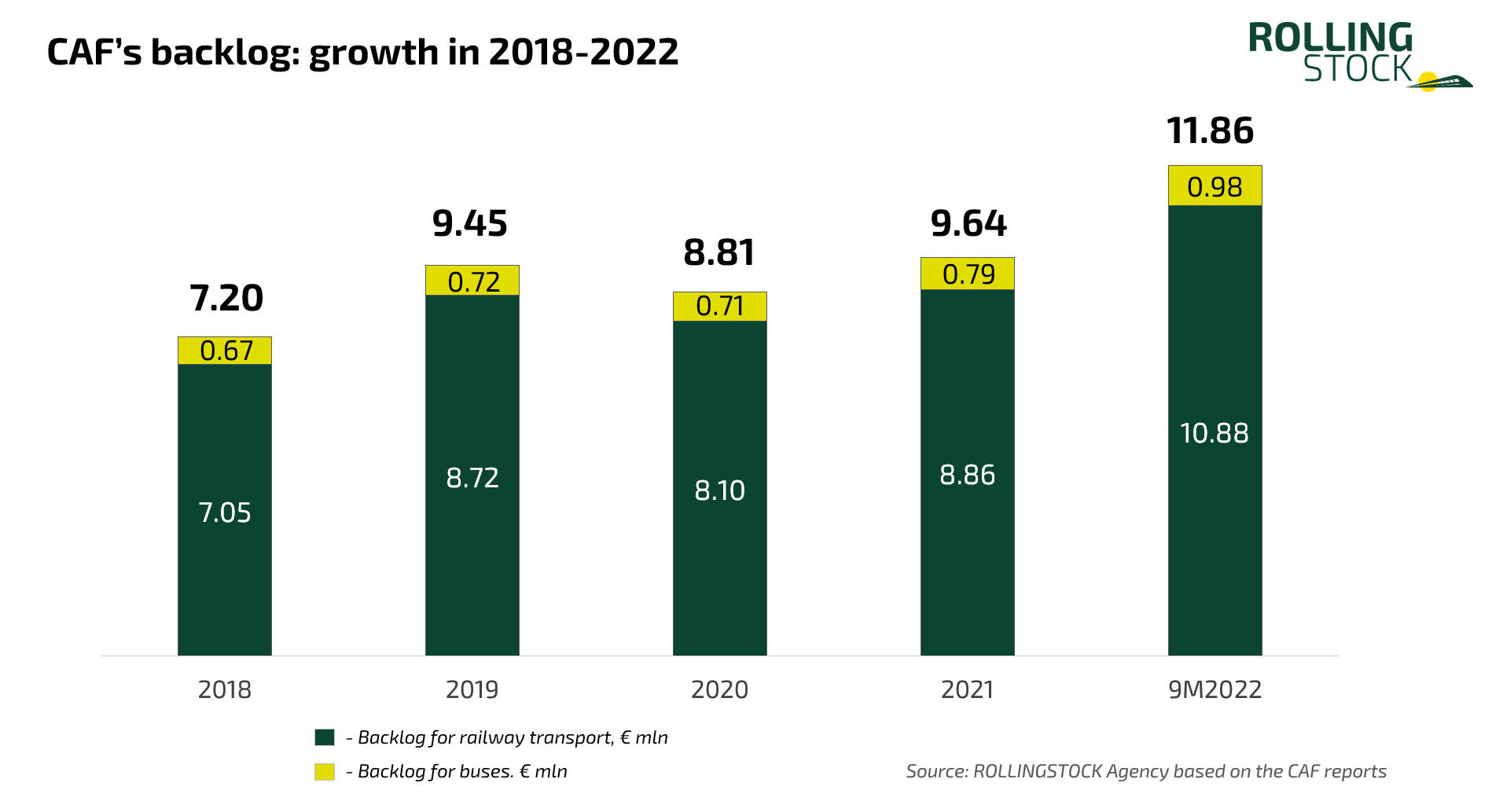

CAF’s current backlog is €11.9 bln (+23% by the end of 2021) with almost 92% in the rail segment. At the end of 2022 it may become even higher taking into account that the company did not include in the latest published report a number of significant contracts worth €1.2 bln, particularly a large order for LRVs in the United States.

(enlarge)

(enlarge)

At the end of 2021 CAF already ranked in the top 8 of the global market for the revenue from the sales of rolling stock. However, significant growth has been noticed only in the tram segment so far. According to SCI Verkehr, CAF accounts for 9% of worldwide tram deliveries in 2020-2022. In this market, CAF is on the same level as Siemens (9%) and gets outplayed only by Alstom gaining its 25% share due to taking over Bombardier Transportation.

According to CAF’s revenue structure, it is developing in a balanced way. The share of new product deliveries is 58%, and service & repairs account for 26%. It is obvious that in the future the services revenue of the producer will grow due to the need to maintain the rolling stock supplied.

This year CAF completed the acquisition of Alstom’s assets. The company obtained not only production facilities but also intellectual rights for Coradia Polyvalent and Talent 3 multiple units platforms at once. Also, CAF produces its own Civity regional train platform in Spain and the UK. The received access to new technologies and engineering staff will increase the company’s lead in such rolling stock offer.

On the other hand, CAF’s sites in Spain benefit is the Algerian natural gas supplies that enhance their competitiveness in the European market. The abandonment of the Russian and Belarusian markets hasn’t influenced much on CAF as the producer has smaller presence there than the major European players.

CAF will continue its growth as the current economic crisis and the weakening of competitors in the European market strengthened the company’s position. The CAF’s development strategy with an emphasis on urban rail transport with a gradual entry into new markets is justified. As the international presence at CAF increases, pressure from Chinese and American companies will grow, too. If the company wants to succeed it needs to invest more in R&D. However, considering that the current market conditions do not foster growth, CAF will be developing slower than Stadler.

Author: Alexander Polikarpov, Managing Partner for Analysis & Consulting, ROLLINGSTOCK Agency