Spain: At the end of 2021, new orders for CAF in this segment amounted to €3 bln EUR, compared to €1.4 bln EUR in the previous year. A significant part was a large order on trains for commuter services in Paris, and 87% of the orders were awarded from European countries.

For example, SNCF and RATP signed a contract worth €2.5 bln with CAF and Alstom consortium for the supply of 146 double-decker trains for operation on suburban lines of the French capital. It is worth noting that initially CAF entered the competition in a consortium with Bombardier Transportation, and Alstom acted as a competitor and litigated the decision of SNCF and RATP. However, in January 2021, Alstom officially took over Bombardier, after what the dispute over the competition ended. In November, it became known that Alstom was selling CAF a factory in Reischshoffen, France, part of a site in Hennigsdorf, Germany, as well as intellectual rights for the Coradia Polyvalent and Talent 3 train platform. The sale of this assets is a requirement of the behavioral conditions imposed by the European Commission for Alstom. The deal should be completed this year.

In the second quarter, CAF received several orders in the passenger rail segment. So, for €250 mln, the company must deliver 28 Civity trains to the Swedish operator AB Transito, while 8 of them should have hybrid traction from the network and biodiesel. Under this contract, it is possible to implement an option for other 26 trains. One of the most notable deals in the third quarter was a contract for the supply of 60 Civity BEMU hybrid trains (catenary + batteries traction) for two regions in Germany.

In light rail, 18 Urbos trams have been ordered by the Belgian operator De Lijn, with another 15 to be supplied to Lisbon in Portugal. The end of the year was marked for CAF by an order for 28 trams from Calgary, Canada.

CAF revenue in 2021 in the railway segment amounted to €2.2 bln and it is 9% higher than the result of 2020 and 14% higher than in the “pre-pandemic” year of 2019. Last year, 44% of total CAF revenue was received from rolling stock supplies, 11% from maintenance services, and 15% from integrated solutions and systems.

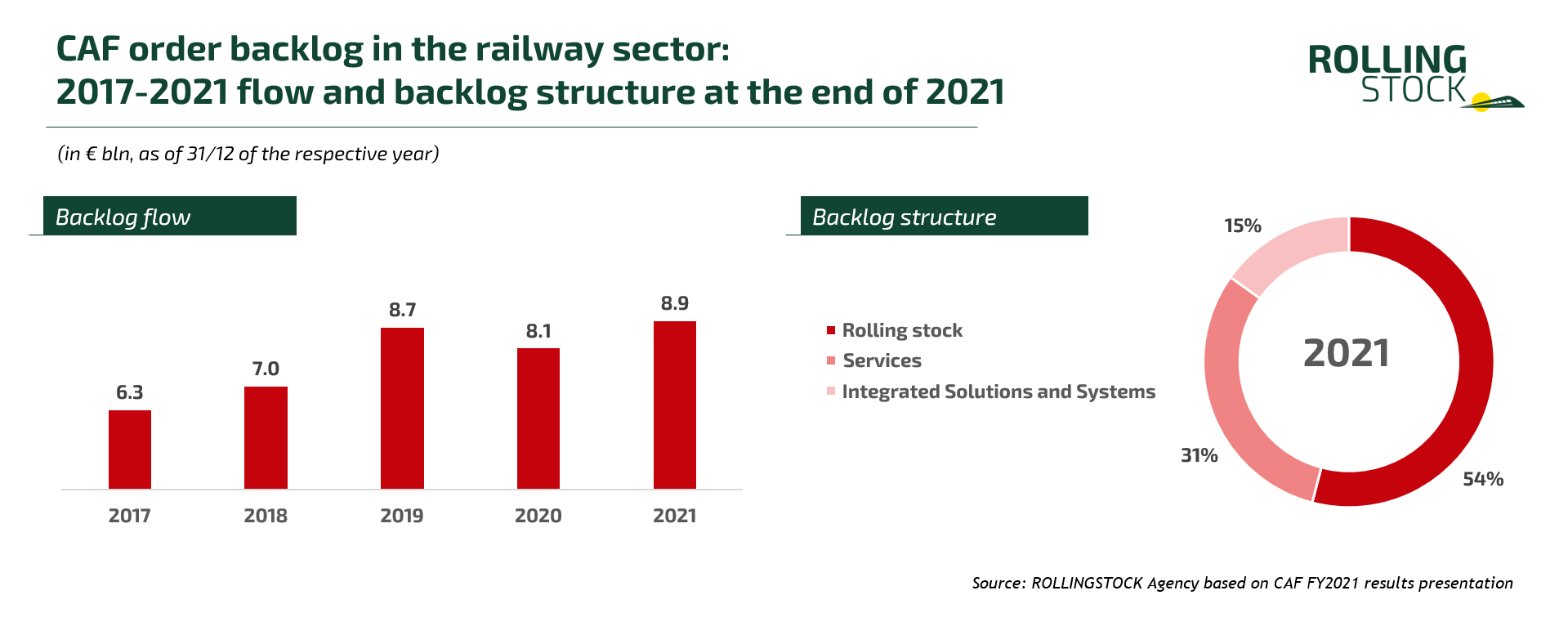

The total order backlog of CAF at the end of 2021 is the largest in 5 years and amounts to €8.9 bln (+9.4% by the end of 2020, +1.5% by the end of 2019). Rolling stock accounts for 50% of the backlog. It is noteworthy that within Spain they account for only 11% of the total backlog, the European market accounts for 59% of orders, the American continent – 11%, the rest of the world – 19%.

CAF manufactures almost all types of the rolling stock. Among them there are the following platforms: Oaris high-speed trains capable of reaching speeds of 350 km/h, regional passenger trains, push-pull cars and Civity passenger cars, Inneo metro trains capable of operating in the unmanned GoA4 mode, Urbos trams and Bitrac locomotives. Currently the manufacturer, as part of the FCH2Rail consortium, is working on a project to convert the Civia 463 three-car train to hybrid traction powered by hydrogen fuel cells cell and catenary.

CAF hydrogen train enters trials, February 2022. Source: railtech.com

CAF hydrogen train enters trials, February 2022. Source: railtech.com

The year has already begun positively for CAF as a part of consortium receiving a €525 mln complex order for a light rail project in Tel Aviv, Israel. It involves the supply of 98 five-car Urbos trams (there is an option for other 32 units), signaling systems and various equipment for the project. Also, CAF will have to deliver 23 electric trains to Auckland, New Zealand, for €135 mln and serve them until 2025.

(

(