UK: The British Railway Industry Association (RIA) has published a report calling on government authorities to develop a strategy to procure and upgrade 500-600 multiple units cars per year to insure workload of at least five existing production sites in the country. In this respect, the association supported two recently published tenders by Northern and Chiltern Railways for the supply of up to 520 trains.

RIA notes that more than 1.5 years have passed since the contract with the Alstom and Hitachi Rail JV was concluded in December 2021. It implied the delivery and maintenance of 54 electric trains for the HS2 high-speed line. Since then, there have been no new orders for passenger rolling stock in the country. The implementation of this contract can’t fully load even two rolling stock plants located in Britain. At the same time, the CAF’s factory in Newport, Hitachi Rail’s in Newton Aycliffe, as well as production facilities of Alstom and Hitachi Rail will gradually complete the execution of orders. RIA accordingly concludes that companies will start reducing staff and eventually close factories.

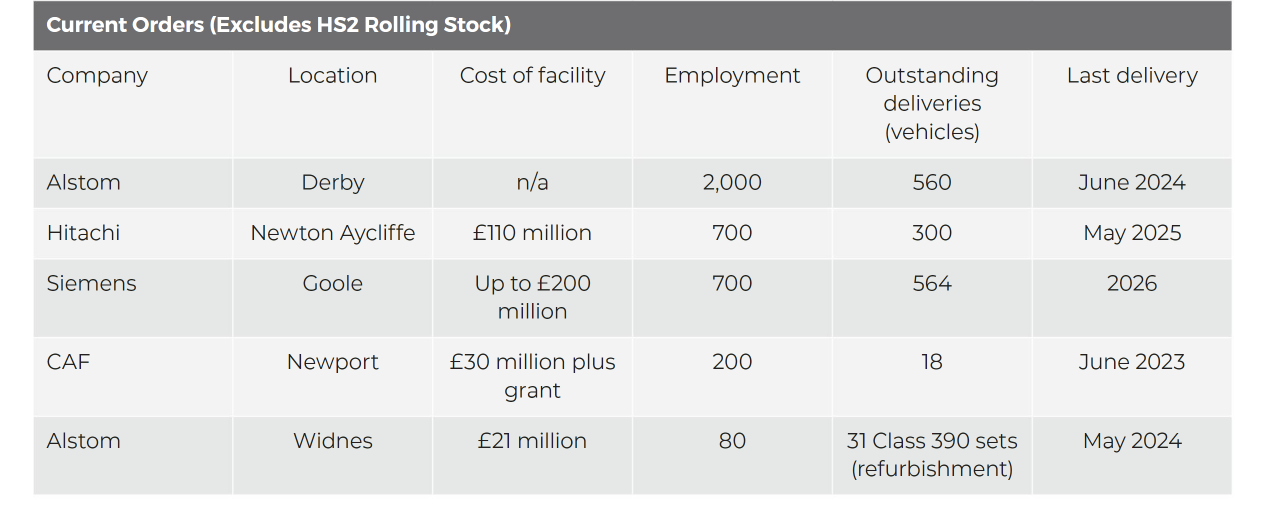

Workload estimates of the largest rolling stock manufacturers in the UK, excluding contract for HS2, as of May 2023 (enlarge). Source: RIA

Workload estimates of the largest rolling stock manufacturers in the UK, excluding contract for HS2, as of May 2023 (enlarge). Source: RIA

In 2010 the production of rolling stock declined to such an extent that only one factory in Derby remained, RIA says. However, since then, new orders have led to the construction of new facilities at Newton Aycliffe, Newport and Goole. Nevertheless, an increase in the production volume of new rolling stock in the same period led to a decrease in modernisation of the operating fleet. It caused the closure of other facilities.

According to RIA, the UK passenger rolling stock fleet includes 21,300 cars (metro, EMU, DMU, locomotive hauled coaches). The association claims that in order to maintain it 500-600 cars are to be purchased or upgraded annually (excluding fleet growth). That should ensure the workload of the capacities available in the country and save the supply chains. Each plant will get the opportunity to have a basic workload level of 150-200 cars per year.

RIA considers that the UK government authorities are to decide this year on financing mechanisms for purchasing or upgrading 2,600 cars, which should start operation by 2030. The modernisation of almost 1,700 diesel train cars with a 35-year service life after 2030 should also be discussed. The association believes that, as part of a policy to reduce carbon emissions, diesel traction should be excluded from procurements. While the share of contracts for hydrogen and battery trains should be increased. RIA also supposes that about 660 diesel trains, which will have served only half of the term by 2040, should be upgraded by equipping them with hybrid traction systems, switching to biofuel, etc.

The RIA report release coincided in time with the publication of two major rolling stock tenders in the UK. Thus, the Northern operator has announced submission of proposals to deliver up to 450 trains over 8 years. New rolling stock is to replace a significant part of the current fleet of Class 195 diesel trains and Class 331 electric trains. The first order will provide options for the supply of battery or electric trains, as well as hybrid trains with the possibility to upgrade them to electric traction in future.

Another operator, Chiltern Railways, has begun collecting proposals for 20 to 70 new or upgraded low-emission trains. A fleet of 39 diesel trains of Class 165 produced in the 1990s is to be replaced in 2027-2028.

RIA welcomed these tenders, but stated that this volume of orders is required annually so that “the supply chain to be able to permanently break out of the historic boom and bust cycle”.