According to the European Parliament’s study on the outlook for the global rail rolling stock market published in July 2023, 20 companies account for 80% of new rolling stock deliveries. The ROLLINGSTOCK Agency analysed the public financial and management statements of 14 major global manufacturers.

From the Rolling Stock Market Trends almanac issued for the International Railway Salon PRO//Motion.Expo 2023

Revenue and order backlog trends show that the industry has already recovered from the global COVID-19 pandemic of 2020. Despite the current geopolitical situation, which has affected many companies, even Russian manufacturers showed revenue growth last year. In 2022, Siemens Mobility and Stadler signed the largest delivery contracts since their establishment, and CAF built up a record backlog of orders.

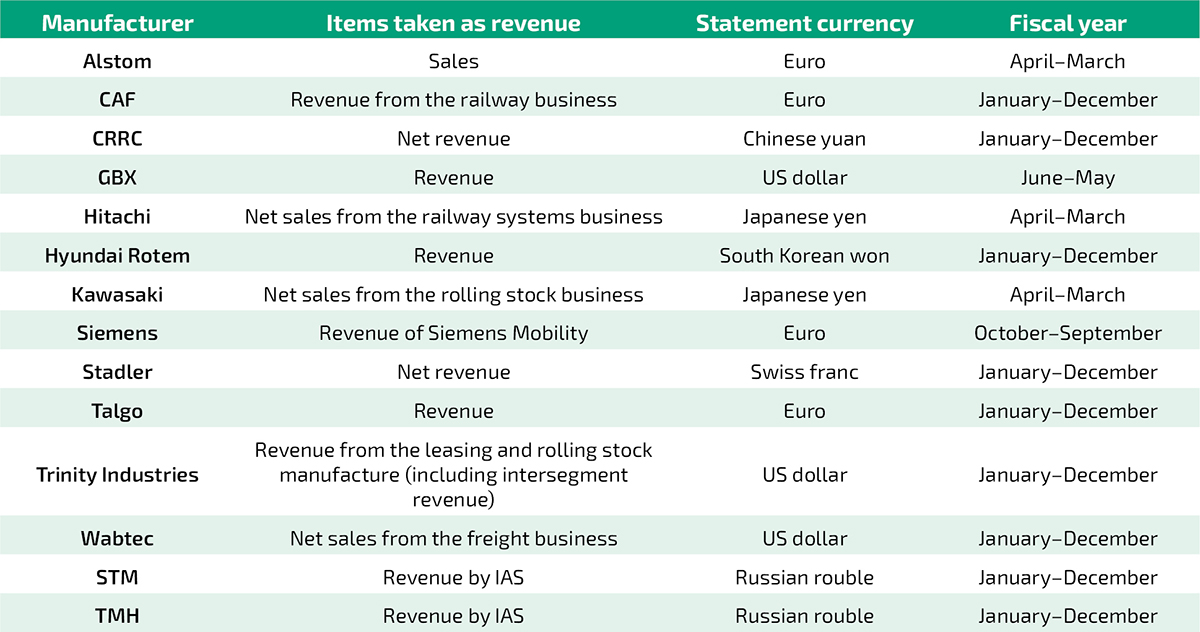

Approach to analysis of the statements

Let us start with an important remark. Many manufacturers are industrial and engineering holdings with diversified activities and unique management accounting systems. In some cases, it is not possible to separate the rail or railway segment, so financial indicators can include other business areas.

We analyse the 2022 performance of revenue and backlogs of orders for:

- 5 companies from Europe: Alstom, Stadler, Siemens Mobility, Talgo, and CAF;

- 3 companies from USA: Wabtec, Trinity Industries, and Greenbrier (GBX);

- 2 companies from Japan: Hitachi and Kawasaki;

- 2 companies from Russia: Transmashholding (TMH) and Sinara-Transport Machines Holding (STM);

- CRRC from China, and Hyundai Rotem from South Korea.

Table 1. Key parameters to compare revenue of the world’s largest producers (enlarge)

Table 1. Key parameters to compare revenue of the world’s largest producers (enlarge)

As the fiscal year varies between countries, revenue data have been adjusted to a calendar year based on quarterly reporting. As GBX’s fiscal year starts in June, its data are given for a period from December of the previous year to November of the reporting year (see Table 1).

Promising performance

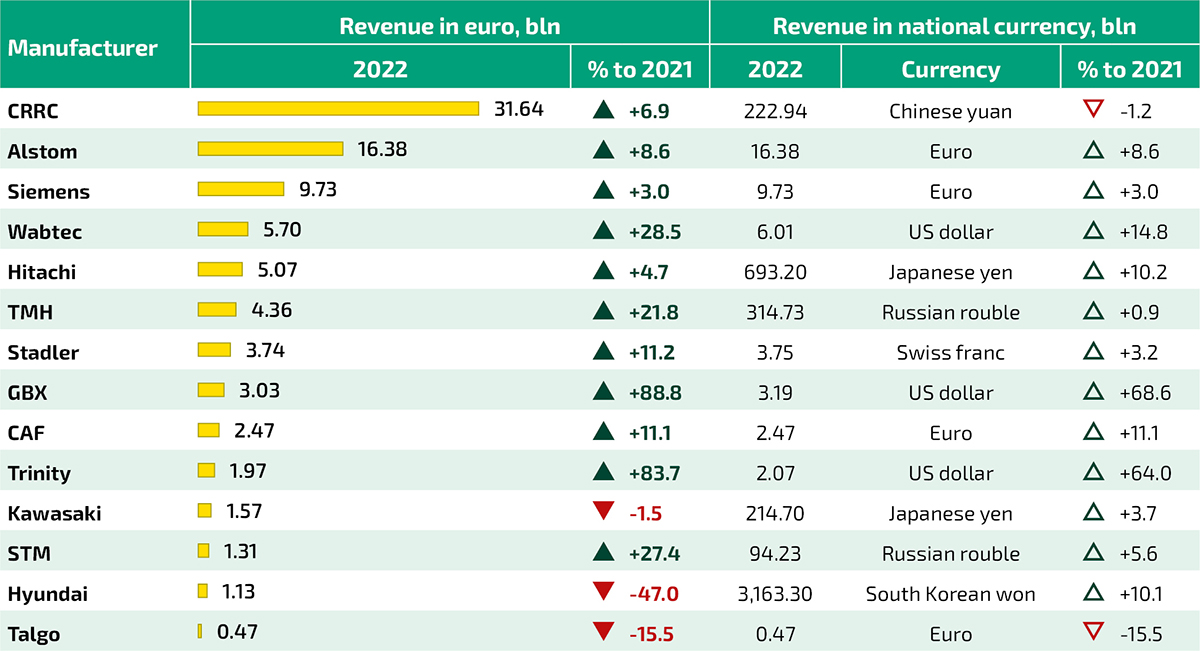

As we noted earlier, in 2022 most manufacturers recovered from the first wave of the COVID-19 pandemic of 2020, which drove revenue growth (see Table 2). Revenue increased even though some European manufacturers left the Russian market and cooperation chains collapsed jeopardising their financial position.

In 2022, CRRC was again the leader in terms of revenue. It outperformed the second company in the list by 93% and the third one by 3.25 times. The domestic market share in its revenue was 89% (-2 p.p. compared to 2021).

The weakening of the euro was a factor that had a positive impact on the non-European companies’ revenues denominated in this currency. For example, in 2022, CRRC’s revenue in euros grew by 6.9% to €31.6 bln by 2021 while in RMB it decreased by 1.2%.

The revenue of Alstom totalled €16.4 bln making it the second largest global manufacturer. Most of its revenue, 53.9% or €8.8 bln, came from the supply of rolling stock. The geography of deliveries is quite diverse: 60.2% of its products are supplied to Europe, 17.2% to the Americas, and 14% to Asia and the Pacific region. The delays in Alstom’s deliveries in 2022 are mainly attributable to contracts awarded to Bombardier Transportation, whose assets the French manufacturer has not yet fully integrated.

The second major European manufacturer, Siemens Mobility, ranked third in 2022 with revenues up 3% to €9.73 bln. The company’s reporting by business segment, which includes rail engineering, presents rather a limited amount of data.

In 2022, a total of 10 out of the 14 companies considered showed an increase in revenue compared to 2021. The highest growth in euro terms was recorded by U.S. and Russian companies, as their national currencies strengthened against the euro.

In 2022, Siemens signed the largest railway contract in its history in Egypt. Source: Siemens

In 2022, Siemens signed the largest railway contract in its history in Egypt. Source: Siemens

Wabtec’s revenue from freight operations totalled €5.7 bln: +28.5% in euros and +14.8% in US dollars. Its significant share is attributable to services and repair (46.8%) and parts and components (15.6%).

This growth lifted Wabtec from the 5th to 4th place and dropped Hitachi to the 5th one with its revenue from the railway systems business of €5.07 bln (+4.7%) to 2021. Compared to the other companies in our analysis, Hitachi stands out for its low domestic market share. This is quite rare for rolling stock manufacturers as their home region is their main or largest market, and they only go international once they have conquered it. At the end of the fiscal year 2022–2023, Hitachi’s revenue from the green energy & mobility market (which includes railway engineering) was distributed as follows: Japan 24%, Europe (its main market) 31.1%, and North America 17.5%.

U.S. freight car manufacturers have returned to pre-COVID production levels. Railways in North America are experiencing high demand for new freight cars, partly because they need to renew their worn-out fleet. In 2022, GBX’s and Trinity Industries’ revenues grew by 88.8% to €3.03 bln and 83.7% to €1.97 bln respectively. Both manufacturers also earn from leasing. The fleet of GBX amounts to 12,300 cars, and the fleet of Trinity — one of the top 5 North American freight car leasing companies — to 141,700 cars, of which 108,400 are owned. In 2022, leasing contributed 5% and 38.9% of the revenue of GBX and Trinity Industries respectively.

Table 2. Revenue of the world’s largest rolling stock manufacturers in 2022 (enlarge). Source: Analysis by ROLLINGSTOCK Agency

Table 2. Revenue of the world’s largest rolling stock manufacturers in 2022 (enlarge). Source: Analysis by ROLLINGSTOCK Agency

With revenues of €4.36 bln, or RUB 314.7 bln in 2022, TMH ranked 6th among the analysed manufacturers. As in other cases, revenues grew by 21.8% in euros and by 0.9% in roubles to 2021. As TMH’s traditional partners left the market and the company faced restrictions in some overseas markets, its revenue suffered a decline in 2022. If shipments to overseas markets generated 18% of the revenue in 2021 (and this was the maximum since 2017), 94% came from Russia last year.

Another Russian player, STM, ranks 12th in our list: its revenue totalled €1.31 bln, or RUB 94.2 bln. Growth in euros was 27.4% and in roubles 5.6%. Revenue from the supply of locomotives and railway equipment grew by 12% (RUB 58.9 bln) totalling 62.5% of the company’s revenue, while revenue from services (excluding locomotive repairs) grew 1.5 times to RUB 10.5 bln.

Russian railway equipment manufacturers continue to adapt to the new business environment, and the most difficult first phase is coming to an end. Companies have been able to maintain production, replace various components from so-called unfriendly countries, and introduce new products with a high degree of sovereignty. In addition, Russian manufacturers are fulfilling existing export contracts and signing new ones, despite having had to officially leave some markets.

In the 7th place in terms of revenue is Stadler, whose revenue grew by 11.2% to €3.74 bln. Most of this came from rolling stock deliveries (86%) and the European market. As for rolling stock sales in other regions, the Americas accounted for 9.6% of Stadler’s revenue and the CIS countries for 1.2% (compared to 4% in 2021).

Hyundai Rotem’s 2022 revenue in euros almost halved to €1.1 bln and grew by 10.1% in South Korean won — mainly due to the weakening of the national currency — putting it in the 13th place.

CAF continues to strengthen its position in the global market. Its revenue from the railway business grew by 11.1% to €2.47 bln, of which 56.7% was from rolling stock supplies, 21.2% from integrated digital solutions and systems, and 22% from services. Revenue growth by sector was +8.9% to €1.4 bln for rolling stock, and +44% to €525.2 mln for digital solutions.

Another Spanish manufacturer, Talgo, saw its revenue fall by 15.5%. The decline was observed in almost all the regions to which it supplies, with the Asian-Pacific region recording the sharpest drop (-60%). Only the revenue from the Middle East and North Africa grew by 26.3% to €123.8 mln now representing 26.4% of Talgo’s revenue in 2022. Domestic shipments fell by 18.4% to €246.8 mln or 52.6% of the total revenue.

Backlogs are also growing

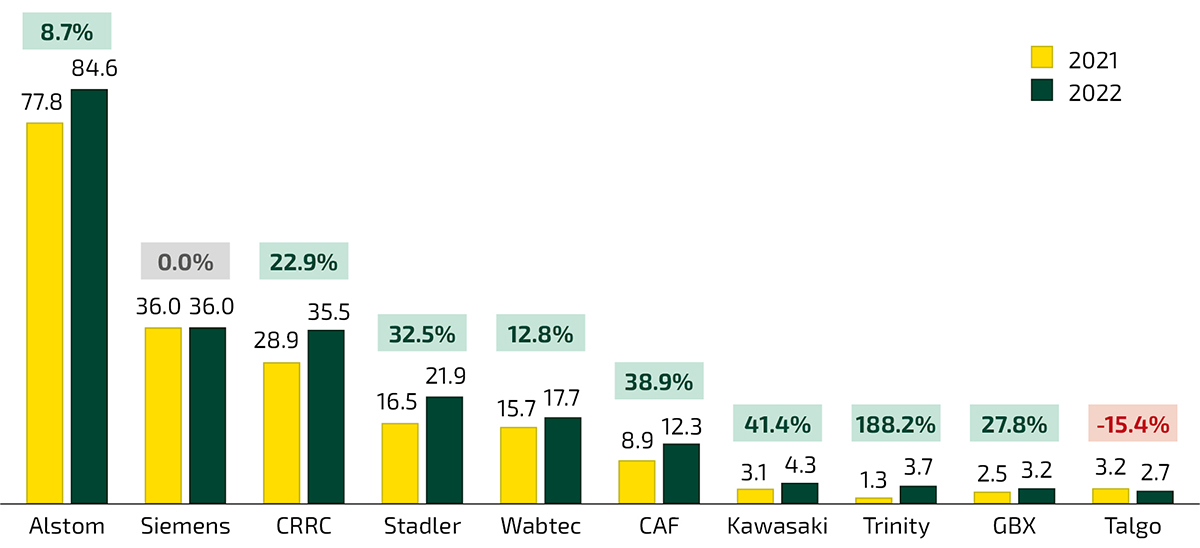

The backlogs of orders reflect the financial position of manufacturers over the next few years, but not all major players disclose them (see Figure 1). Below, we analyse the backlogs as of 31 December 2022, and only GBX’s data are given as of 30 November 2022.

Alstom’s merger with Bombardier Transportation has significantly increased its backlog compared to other global players. If at the end of 2020, Alstom had orders for €40.1 bln, at the end of Q1 2021 its backlog included Bombardier’s orders reaching €74.5 bln. The growth continued in the following quarters, so that by the end of 2022, the orders totalled €84.6 bln, 2.35 times the figure boasted by its closest competitor, Siemens Mobility. So in terms of backlog of orders, Alstom maintains its position as a strong industry leader. About 49% of its 2022 backlog accounts for rolling stock and 35% for maintenance services, with more than half of the future supplies going to European countries.

The backlog of Siemens Mobility remains at the level of 2021 year-end, at €36 bln, despite the largest contract in its history for the construction of a high-speed rail network and the supply of rolling stock signed last year. The manufacturer is expected to deliver 41 Velaro, 94 Desiro High Capacity trains, and 41 Vectron electric locomotives to Egypt in cooperation with local companies. Siemens Mobility’s share in the Egyptian project amounts to €8.1 bln. At the end of December, another large tender was won for the supply of 1,200 mainline electric freight locomotives to India for about Rs 260 bln ($US 3.2 bln) excluding taxes and price fluctuations. This order is unlikely to have been included in the backlog on 31 December 2022.

The global industry leader by revenue, CRRC, ranks 3rd with a backlog of €35.5 bln (RMB 250.1 bln) which is comparable to its annual revenue. Its share of long-term domestic contracts is likely to be minimal, as its backlog of new orders for the year exceeds its revenue in 2022 and orders received in the previous years. If the share of long-term domestic orders increases, CRRC can lead the industry in terms of order backlog. At the end of 2022, the share of export contracts was 39.5%.

Figure 1. Backlog of the world’s largest rolling stock manufacturers in 2021–2022, € bln (enlarge). Source: Analysis by ROLLINGSTOCK Agency

Figure 1. Backlog of the world’s largest rolling stock manufacturers in 2021–2022, € bln (enlarge). Source: Analysis by ROLLINGSTOCK Agency

Increasing demand for new freight cars in North America led to the growth of GBX’s backlog by 27.8% to €3.2 bln (or by 14.1% to $3.4 bln), however, the company had not announced any major contracts. At the end of 2022, GBX was the second player in the North American rail car market with 34% of regional and 24% of European orders in the backlog.

Wabtec’s orders grew by 0.7% in national currency and by 12.8% in euros (€17.7 bln) reaching the level of pre-COVID 2019.

Kawasaki Rail increased its backlog by 41.4% to €4.3 bln (¥590.2 bln) by exercising a $1.7 bln option for 640 cars for the New York City underground. The new trains will be manufactured at its two U.S.-based plants in Lincoln and Yonkers.

As in 2022 Stadler signed several large contracts and received numerous smaller orders, its backlog in the reporting segment grew by 32.5% to €21.9 bln (or by 23% to CHF 22 bln). At the beginning of the year, for example, the company won the largest tender in its history. The €4 bln contract is for the supply of 504 tram-train cars to six operators in Germany and Austria (VDB Tram-Train project). In a consortium with Siemens Mobility and ST Engineering, Singapore, the Swiss manufacturer is expected to build and deliver 25 three-car GoA4 trains for the Kaohsiung MRT Yellow Line in Taiwan for $4.7 bln. Another example of an order is an option exercised by Renfe for 20 Stadler trains worth €307 mln.

The 2022 backlog of Stadler does not include the delivery of 537 passenger coaches for the Kazakhstan Temir Zholy announced last December. The €2.3 bln contract also provides for 20-year maintenance of the coaches.

At the end of 2022, CAF reported a record backlog in its history. Orders totalling €12.3 bln grew by 38.9% compared to 2021. New contracts were signed all over the world, and the largest one worth $811 mln is for the delivery of 102 seven-car low-floor trams to Boston, USA. Together with Shapir, CAF won a tender for the construction and maintenance of a tram line in Tel Aviv and the delivery of 98 Urbos trams to Israel. The Spanish manufacturer’s share is €525 mln. In December, the Dutch rail operator Nederlandse Spoorwegen ordered 60 partially double-decker electric trains (30 four- and 6-car each) for more than €0.6 bln.

CAF reported a record backlog at the end of 2022. Source: Karlos Corbella/mafex.es

CAF reported a record backlog at the end of 2022. Source: Karlos Corbella/mafex.es

Of the companies from our analysis, Talgo is the only one whose backlog did not grow in 2022. As at 31 December 2022, it decreased by 15.4% to €2.7 bln, or €3.0 bln if we consider already awarded contracts subject to conditions precedent. The list of ongoing projects includes the design and manufacture of 23 Intercity Talgo 230 trains for Deutsche Bahn and 8 for DSB, Denmark. The maintenance business represents 71% of the 2022 order book (€2 bln) and includes services for customers in Spain, Germany, Saudi Arabia, Kazakhstan, Uzbekistan, Egypt, and the USA. In March 2022, Talgo cancelled all services in Russia.

Russian manufacturers do not disclose their backlogs. Meanwhile, the practice of concluding long-term contracts for the supply of rolling stock and track machines is spreading in the country, and the annual volume of supplies is significant. So it can be assumed that by the order book size, both TMH and STM are quite close to the largest players, and thanks to long-term contracts with Russian Railways for the supply of locomotives and track machines they can take the leading positions, which will contribute to a dramatic improvement of the investment climate in the Russian railway engineering industry.