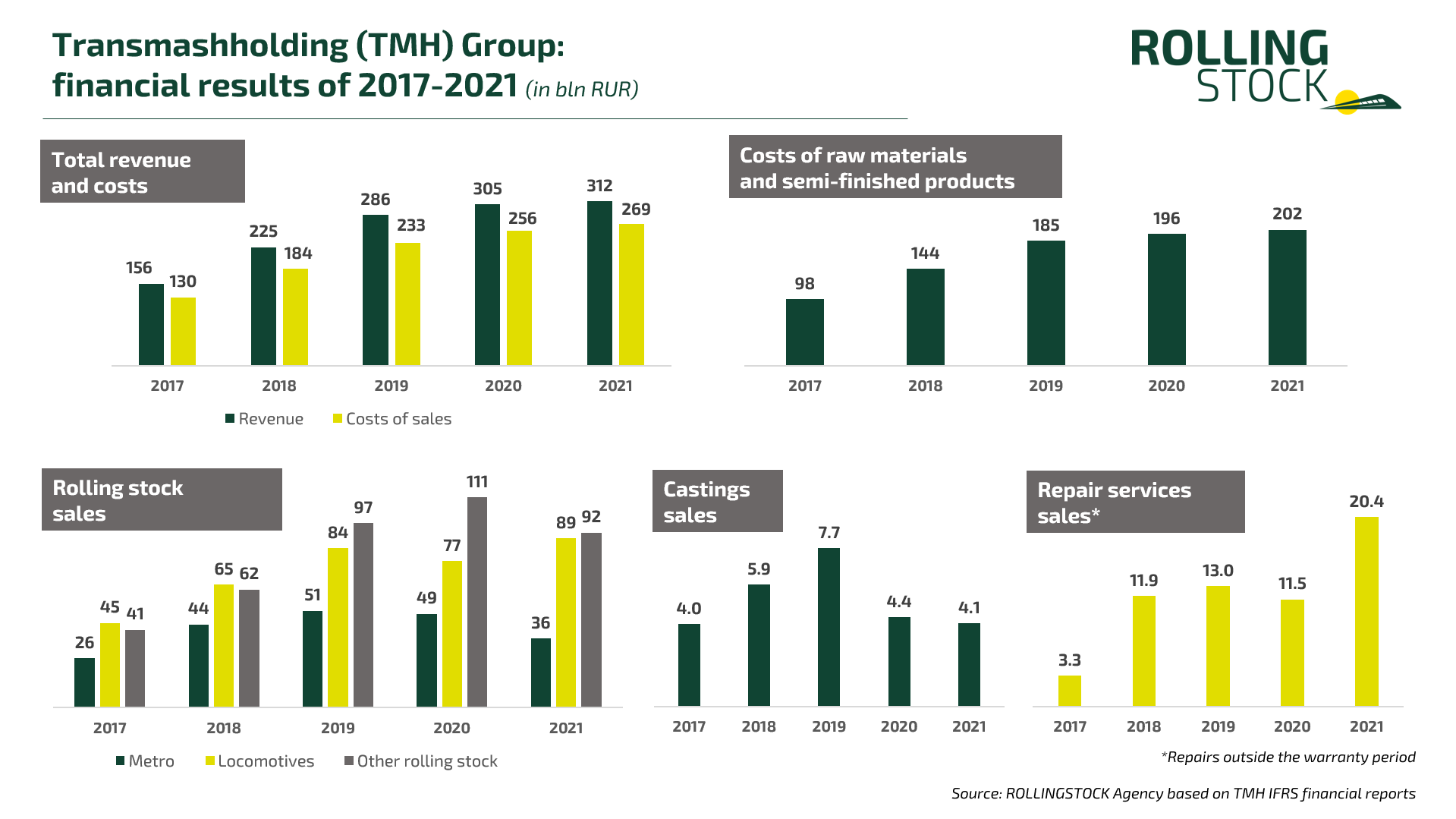

Russia: The largest manufacturer of rolling stock in Russia has published IFRS financials for 2021. Against the backdrop of negative economic effects caused by the coronavirus pandemic and inflation, the holding managed to end the year with a profit.

According to the report, the revenue of Transmashholding (TMH) in 2021 amounted to 311.9 bln RUR. (+2.1% by 2020, approx. $4.2 bln USD). As to the holding, about 82% of sales fell on the Russian market, where the main customers were Russian Railways (RZD) and the Moscow Metro. In 2020, the Russian market accounted for 91% of TMH deliveries.

The costs for TMH in 2021 amounted to 269 bln RUR (+5.2%, $3.65 bln USD). At the same time, the holding spent 201.6 bln RUR ($2.7 bln USD) on raw materials and semi-finished products (+3.0%). As a result, at the end of the year, TMH records a profit of 8.6 bln RUR ($0,1 bln USD), which is 63% lower than the result of 2020.

TMH received a record revenue for 5 years from the sales of locomotives – 89 bln RUR in 2021 (+15.4%, $1.2 bln USD). At the same time, at the beginning of last year, a significant reduction in purchases of locomotives by the main customer, RZD, was expected to 500 vehicles against 566 a year earlier. But later the RZD order was subsequently increased, and 538 locomotives were purchased at the end of the year. In turn, by order of RZD and other clients, in 2021 TMH produced 523 sections of mainline electric locomotives (69% of the total production in Russia), 260 sections of mainline diesel locomotives (100%) and 239 shunting diesel locomotives (83%).

Revenue from the sales of metro cars amounted to 36.3 bln ($0.5 bln USD), which is 26.5% lower than in 2020, and is the lowest figure in 5 years. The TMH’s largest contract in this segment is the delivery of 1,360 metro cars (170 trains) for Moscow in 2020-2023 for 135.4 bln RUR, VAT included. According to the financial plan for 2021, the city pledged 33.8 bln RUR ($0.46 bln USD). In 2021 TMH handed over 337 cars to the Moscow Metro for the specified amount, and in total produced 421 metro cars (100% of the total metro cars production in Russia).

From the supply of the rest of the rolling stock (multiple units, passenger and freight cars, etc.) TMH earned RUB 92.0 bln ($1.25 bln USD) in 2021, which is 16.8% less than in 2020. In particular, over the past year, the manufacturer produced 1,085 passenger coaches (100% of the total production in Russia), 319 EMU cars (69%) and 1,580 freight cars (2.5%).

In the field of repair services outside the warranty period, TMH revenue almost doubled: from 11.5 bln RUR ($160 mln USD) in 2020 to 20.4 bln RUR ($275 mln USD) in 2021. Castings sales decreased by 6.7% to 4.1 bln RUR ($55 mln USD), the lowest level since 2018.

TMH investments in the production in 2021 amounted to 10.1 bln RUR (-12.8% by 2020, $137 mln USD) and are the lowest in the last 4 years. As indicated in the report, TMH’s contractual obligations in relation to the acquisition of fixed assets and intangible assets, including R&D results, at the end of 2021 amounted to 11.9 bln RUR. (+74.2% by 2020, $161 mln USD).

The manufacturer expected the decrease in results the year ago. Last summer, in an interview with Railway Equipment Journal, TMH CEO Kirill Lipa noted that the rolling stock market remains high in terms of demand, however, against the backdrop of softening the policy of financial regulators, prices for raw materials and supplies have risen radically. The published IFRS report indicates that the TMH’s management is currently assessing the impact of sanctions on the company’s operations, introduced against Russia because of the situation in Ukraine, and develops measures designed to fend off its negative impact.

(

(