China: The readiness of the world’s largest rolling stock manufacturer to play by the rules of localisation is increasing. In particular, the company confirmed its willingness to establish production in Portugal.

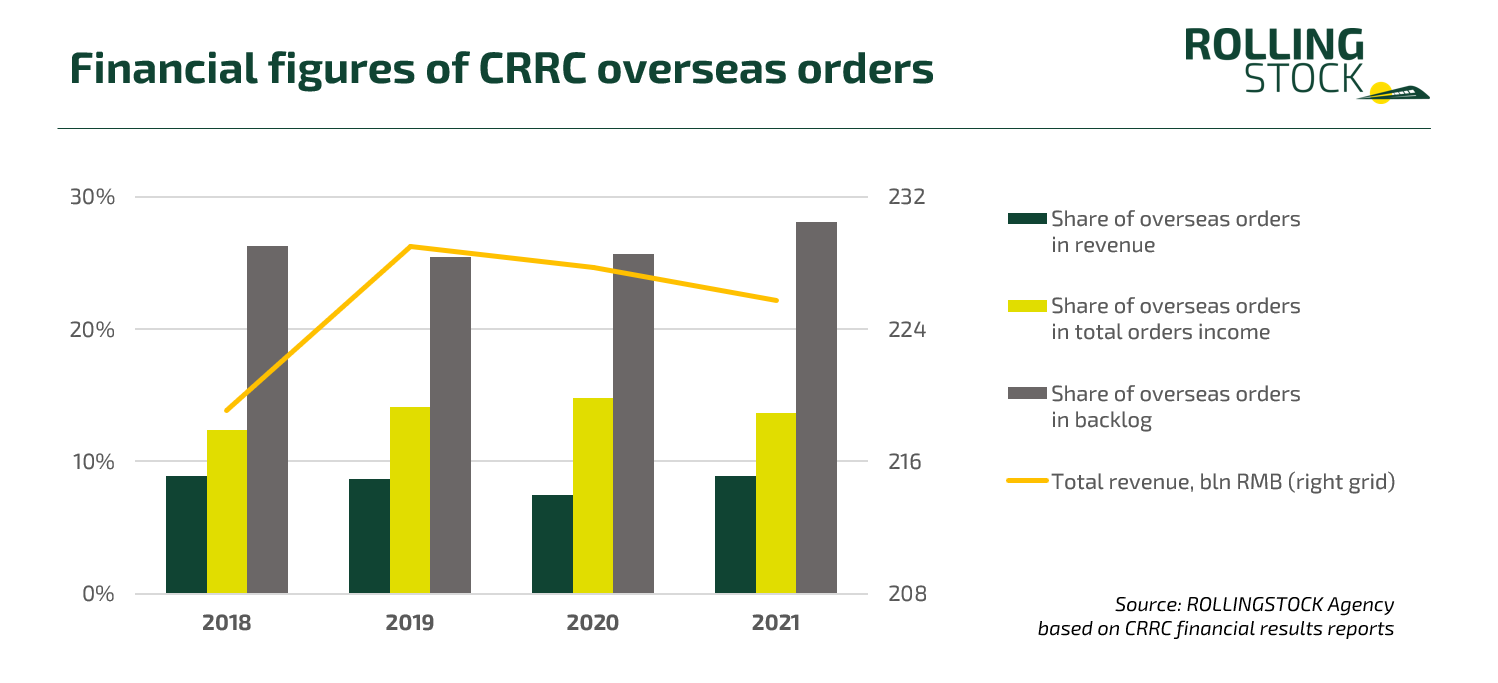

As CRRC’s financial results for 2021 show, even against the backdrop of declining domestic demand, the share of foreign contracts in new orders is the lowest in 3 years. CRRC’s breakthrough into international markets occurred in 2018, when export contracts in order income exceeded 10% of the volume and amounted to 43 bln RMB (12.4% of receipts, $6.5 bln USD). The peak of export contracts so far came in 2019, when overseas orders amounted to 48.1 bln RMB (14.1% of revenue, $7 bln USD).

In 2020, against the background of a sharp decrease in domestic orders by 18%, the share of СRRC’s export orders reached almost 15%, but in financials it fell to 42 bln RMB ($6.1 bln USD). At the end of 2021, the income of export orders for CRRC decreased to 35 bln RMB (-17% by 2020, $5.4 bln USD), and its share in the total volume of new orders decreased to 13.7%.

The manufacturer’s published financial results also show CRRC’s revenue decline for the second year in a row. In 2021, CRRC received 225.7 bln RMB ($35 bln USD), down 0.85% from 2020 and 1.4% from 2019. Deliveries within China accounted for 91.1% of CRRC’s revenue, and export deliveries for 8.9%. In the past two years, CRRC’s delivery of rail vehicles, urban vehicles and urban infrastructure solutions brought 65% of its revenue on average.

Significant losses in CRRC’s revenue are noted in the deliveries of multiple units, which also includes high-speed trains. So, if in 2019 CRRC sold these products for 64.2 bln RMB ($9.3 bln USD), then in 2021 this segment brought the company only 41 bln RMB ($6.4 bln USD) – this is the minimum figure for 5 years. CRRC reports that it delivered 1,292 units of the MU rolling stock in 2021. For comparison, in 2019 the manufacturer shipped 2,167 units, in 2017 – 3,592 units.

Also in 2021, CRRC sold 744 locomotives, 1,019 passenger coaches, 8,045 urban transport cars (metro, trams, monorail, maglev for low and medium speeds) and 33.7 thsd freight cars. Earlier CRRC reported that its production capacity allows it to produce 1,530 locomotives, 2,300 passenger coaches, 11,840 urban transport cars and 51,500 freight cars annually.

CRRC’s total backlog by the end of 2021 was 220.3 bln RMB ($34.2 bln USD), down 8.7% from the end of 2020. Its volume is comparable to the volume of new orders for the year (221 bln RMB or $34.3 bln USD), which, against the backdrop of a large share of domestic deliveries, indicates the absence of a long-term order and the annual adjustment of investment programs in China. For comparison: Alstom, another world’s largest market player, had an order portfolio of €77.8 bln in 2021, the smaller Stadler Rail – €17.5 bln, CAF – €8.9 bln.

Maglev train production at CRRC’s Changchun site, 2020. Source: Xinhua

Maglev train production at CRRC’s Changchun site, 2020. Source: Xinhua

CRRC is taking various steps to grow its presence in the international market: offers significantly lower prices compared to competitors, buys production sites on the target markets (in particular, Vossloh Locomotives in Germany), forms a scientific and engineering basis for expansion (as of June 2021, CRRC had 40 institutes and 18 research centers in other countries).

As the US and EU are trying to resist CRRC’s expansion, the Chinese manufacturer is ready to invest more seriously in the creation of local production. In particular, CRRC has confirmed in media comments its readiness to establish production in Portugal, and in 2021 it registered a subsidiary of Portugal CRRC. The localisation of production in the country is involved in the tender requirements by Comboios de Portugal (CP) for the delivery of 117 electric trains. Almost all major manufacturers have applied for participation in it.

(

(