Australia: The Australasian Railways Association (ARA) has estimated that due to the lack of a national rolling stock procurement policy, the country’s regional budgets lost about 1.85 bln AUD ($1.2 bln) as a result of the deals. The government plans to establish appropriate bodies to address the issue.

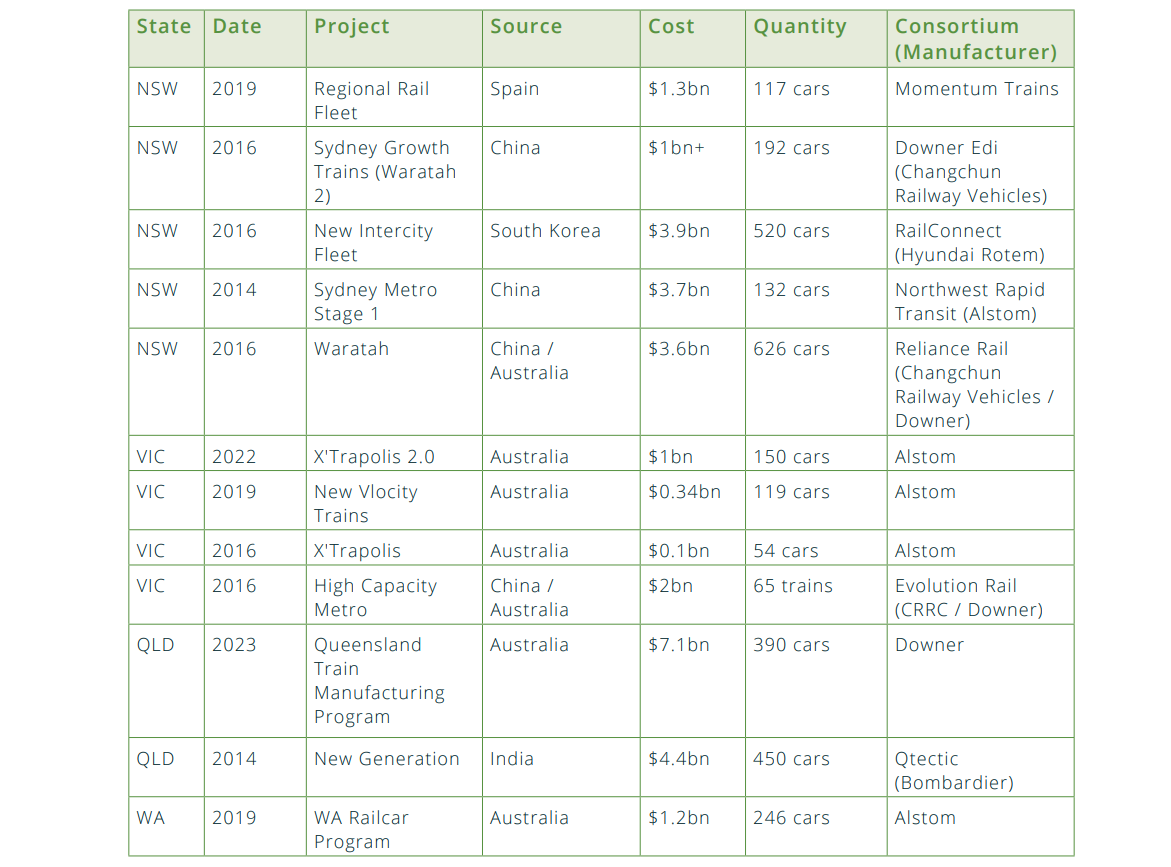

ARA has published a study analysing 12 contracts for rolling stock. These were concluded between 2014 and 2023 and covered the supply of 3,061 diesel, electric and metro train cars at a total cost of 29.6 bln AUD ($19.9 bln).

Rail passenger rolling stock contracts in Australia analysed by ARA, in AUD (enlarge). Source: ARA based on BIS Oxford Economics (BISOE)

Rail passenger rolling stock contracts in Australia analysed by ARA, in AUD (enlarge). Source: ARA based on BIS Oxford Economics (BISOE)

Researchers estimate that state governments could save 811 mln AUD ($545.2 mln) by reducing the cost of designing rolling stock. According to ARA, manufacturers have to develop trains for each state separately, thereby duplicating their projects. Moreover, 717 mln AUD ($482 mln) could have been saved by combining small orders for several states into a large one. Additional savings of 318 mln AUD ($213.8 mln) could have been achieved by major componentry harmonisation. The estimates are based on a study the ARA conducted earlier in 2013 together with Deloitte. At that time, it was calculated that the cost of ordering 50 single-deck cars would be two-thirds higher than a single order for 150 such cars.

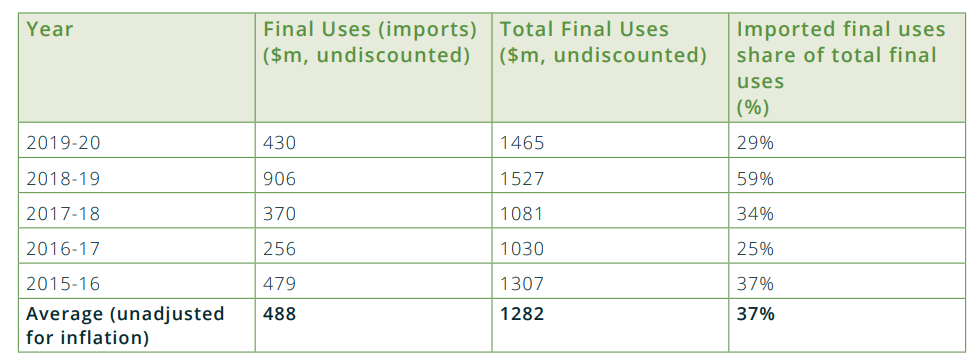

The study also examines the competitiveness of the Australian railway industry compared to imports. It notes that each state’s own industrial policy supports ‘in-house’ manufacturers and has the short-term positive effect of generating jobs, but creates trade barriers between states by equating ‘non-domestic’ Australian suppliers with overseas ones. In the long term, this undermines the sustainability of the national rolling stock industry, according to ARA.

Imports of rolling stock to Australia, in AUD (enlarge). Source: ARA based on the data of the Australian Bureau of Statistics

Imports of rolling stock to Australia, in AUD (enlarge). Source: ARA based on the data of the Australian Bureau of Statistics

The association believes that introducing a unified national approach to rolling stock procurement will save states money on infrastructure projects and allow the rail industry to improve its competitiveness, resulting in additional jobs and revenues for local and national budgets. In line with the above recommendations, ARA signed a Memorandum of Cooperation with the Australian and Victorian Governments late in March. In the near future, the Australian government plans to establish a National Rail Advocate and Rail Industry Innovation Council to develop national rail standards and support Australian rail manufacturing.

Australia has historically had its own capacity to produce almost the entire range of rolling stock, but in recent years global players have significantly expanded their presence in the country. Thus, one of the major players, UGL Rail, produces double-deck trains for the Sydney regional services in conjunction with Korea’s Hyundai Rotem and Japan’s Mitsubishi Electric. Another major manufacturer, Downer Rail, has formed a consortium with China’s CRRC. In addition, after the takeover of Bombardier Transportation, France’s Alstom has a significant presence: it has three production sites in Australia and a design bureau in Ballarat. Also, American Wabtec and Progress Rail locomotives, CRRC track machines and freight cars, Spanish CAF trains and trams are represented as imports to Australia.