USA: Logistical problems with imports from China and a sharp deterioration in relations between Russia and the United States amid events in Ukraine put the supply of wheels to American car builders at risk. At the same time, the capacity of US manufacturers can fully cover the need for wheels to produce more than 60,000 freight cars, writes Robert Cantwell, Principal of Rail Supply Chain Associates, in Railway Age.

According to him, every year American companies buy more than 1.2 mln wheels, most of which come from abroad. Persistence Market Research estimates that the USA solid railway wheel market was $553.4 mln USD in 2021 and could reach $878 mln USD by 2026. A significant share of demand comes in the freight cars segment, with the Railway Supply Institute trade association recording that 29.3 thsd freight cars were produced in the USA in 2021 (the lowest amount in 5 years), and the order backlog of American freight car builders at the beginning of January 2022 included contracts for almost 43 thsd cars (+24% compared to the beginning of January 2021).

At the moment, 22 factories in the world are certified by the Association of American Railroads (AAR) and allowed to supply wheels to the country’s railway industry. US and China are the location for 5 of them each, per 2 are situated in Russia and Brazil, and 1 plant each in Ukraine, Canada, Japan, France, Spain, Italy, the Czech Republic and Australia.

China occupies the main share in wheel import to US, while only 3 plants are currently providing it, and 2 other enterprises were created more than 30 years ago as joint ventures with Amsted Rail and supply wheels exclusively to the domestic market. The remaining plants that supply the US market are owned by state-owned Taiyuan Heavy Industries and Maanshan Steel.

According to Cantwell, the driver for the Chinese components producers expansion to the US market is the largest global rolling stock manufacturer, CRRC, which has received significant orders in the country in the past decade. In 2020, a law was passed in the United States prohibiting public procurement of the CRRC rolling stock for reasons of threats to cybersecurity, but in 2021, with the advent of the administration of the new US President Joe Biden, CRRC got the relaxation of the rules. Thus, the company was excluded from the Chinese military companies list that is managed by the US Department of Defense.

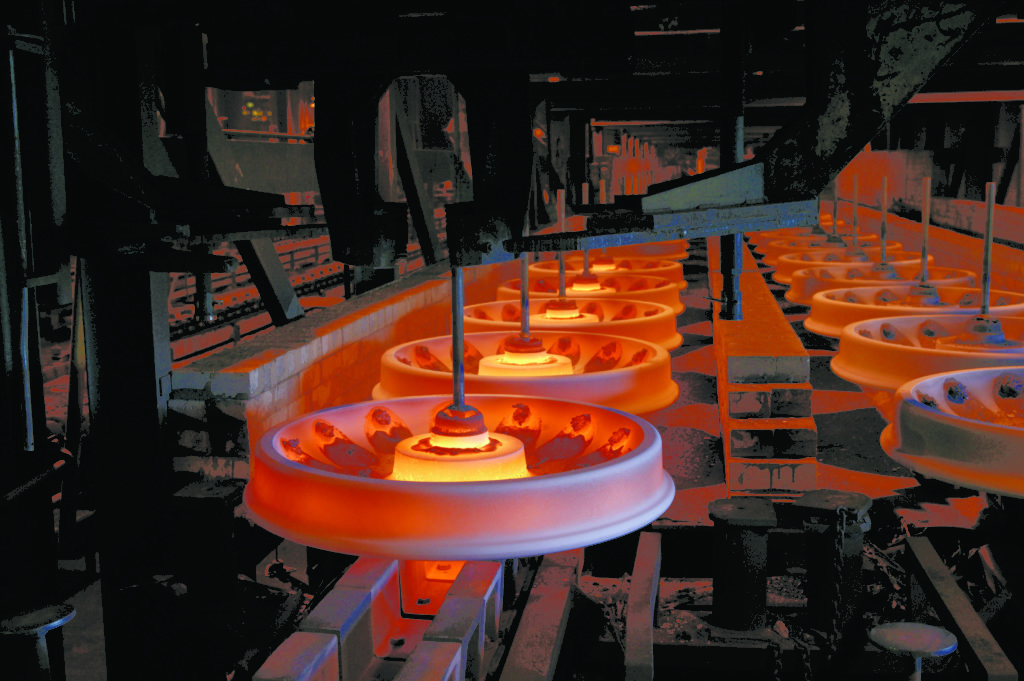

Manufacture of solid Griffin Wheels at the Amsted Rail plant in the USA. Source: railwayage.com

Manufacture of solid Griffin Wheels at the Amsted Rail plant in the USA. Source: railwayage.com

Cantwell is also concerned about the import of wheels from Russia. Thus, 10 models of Evraz wheels, which are produced at the Nizhny Tagil Iron & Steel Works and are applicable in freight cars and locomotives, have the AAR certificate. Another Russian manufacturer, the United Metallurgical Company (OMK), has an AAR certificate for 1 wheel model for freight transportation. Cantwell, along with China, calls Russia the largest importer, but does not give any figures. According to the expert, last year Evraz’s revenue from railway products in the US amounted to $392 mln USD, but most of it came from the sale of rails (the company occupies 48% of the rail market in North America).

In the US itself, the industry is represented by Amsted Rail (4 plants in the US and 1 in Canada) and Sumitomo Standard Steel (1 plant in the country). According to Cantwell’s estimates, the capacities of these enterprises can ensure the production of up to 480,000 wheels for a prospective demand of 60,000 freight cars. However, when compared with the total annual demand for wheels, it turns out that US wheel producers can only cover 40% of the needs of the US rolling stock market. At the end of the article, Cantwell calls for strengthening the national component base to level the current geopolitical risks.