EU: Europe’s Rail, a partnership of major operators and manufacturers, has updated its estimates of the potential costs the introduction of digital automatic couplers (DAC) on freight cars operated will bring. The estimates and the initiative itself have attracted criticism by ZNPK, an association of minor operators from Poland.

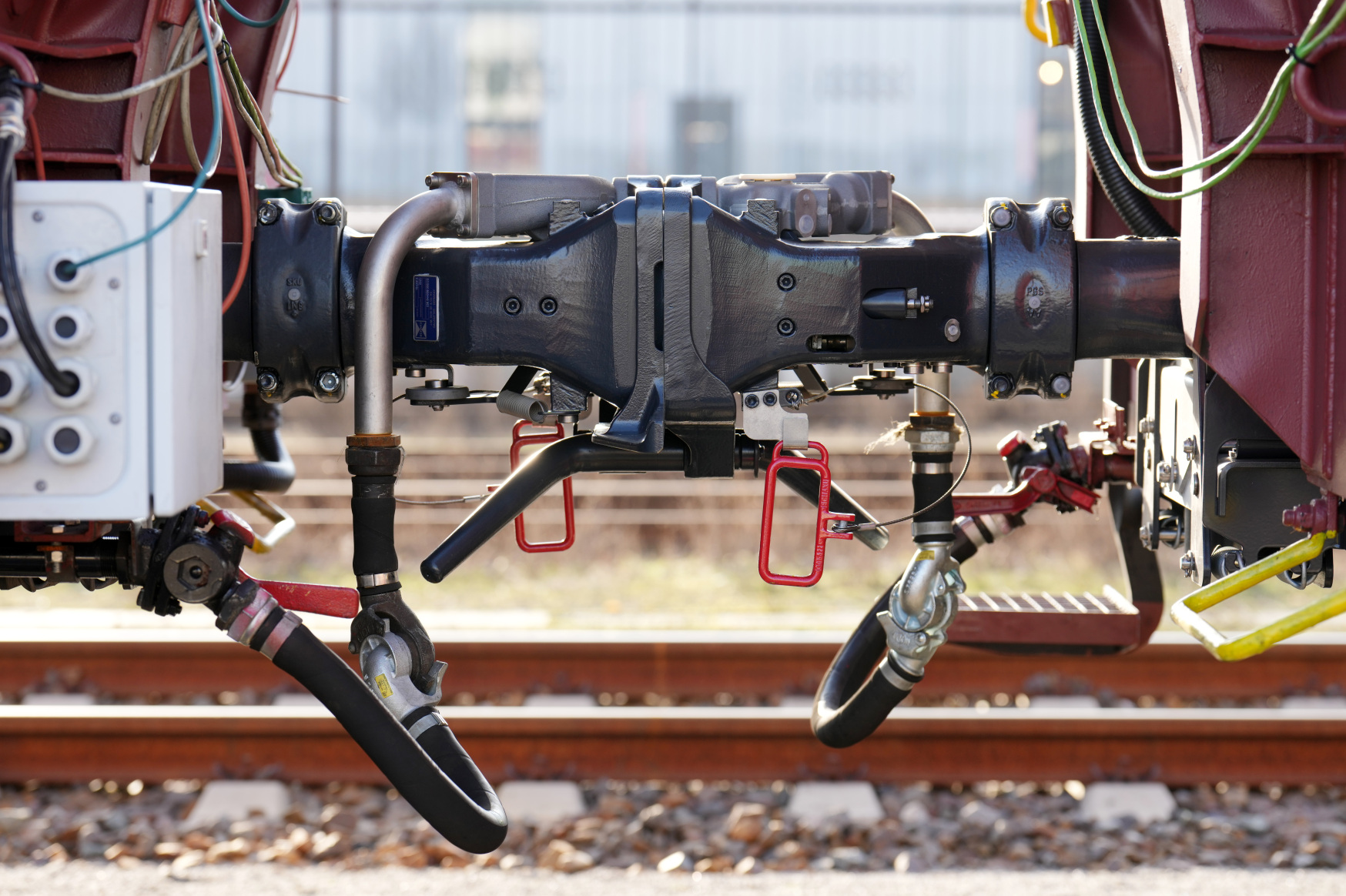

The idea to introduce DAC throughout the EU has been in development since the second half of the 2010s. It is expected that mass migration from obsolete screw coupling will start in 2026. DAC will be used not only on rolling stock but on brake mains, power and data lines, promising the improvement of efficiency of rail freight transport and the attraction of customers that now use motor vehicles. Today, DAC4EU, a consortium of European companies promoting DAC, has selected Scharfenberg couplers by Dellner and Voith. One of these will be introduced after the completion of the service testing which began in early 2022 and later was extended to the end of 2023. In April, Sweden started independent testing of a DAC prototype by Knorr-Bremse.

Europe’s Rail estimates

On 20 March, Ernst & Young (EY) presented a report on financing mechanisms for DAC implementation, prepared by order of Europe’s Rail in December 2022. Europe’s Rail is an EU joint undertaking of major operators — SNCF, Deutsche Bahn, Trenitalia, OBB, Ceske drahy, etc. — and rolling stock and component manufacturers like Alstom, Siemens Mobility, CAF, Talgo, Knorr-Bremse.

According to EY’s report, the capital expenditure of installing DACs on 460,000 freight cars and locomotives over six years (2026–2031) will amount to €9 bln. Of these, 410,000 vehicles will be upgraded, and 50,000 will replace those written off. €1.5 bln more will allow their maintenance over the same period.

Two financing scenarios can be found in the report, and both involve significant state support. In the first scenario, operators receive grants from the European Investment Bank and other public institutions. Over 18 years this support will cover almost all €8.8 bln of capital expenditure, however about €2.5 bln for operational and extra expenses will require additional subsidies. The second scenario — and the most probable one, as the analysts believe — provides for the EU’s funding of 71.5% of capital expenditure, i.e. €6.5 bln, over six years, and loans from private banks and private investments to cover the remaining €2.5 bln.

The calculation model by EY assumes a DAC cost of €5,000 per unit, however, no data on the basis of the estimate is available. According to the analysts, the expected economic impact of €12 bln over 30 years will be felt from 2030, meaning that before that operators will face a significant increase in financial burden. The report presents challenges associated with the preparation of repair facilities to support DAC migration and with the availability of couplers production capacities.

Europe’s Rail describes the study by EY as an investment plan to introduce DAC under the European DAC Delivery Programme (EDDP) approved before. In a communication to International Railway Journal, Europe’s Rail and the department for mobility and transport DG MOVE highlight EDDP is a “fully open platform” to develop a technically and economically feasible final plan in no time. Related activities involve 80 companies from 20 EU countries. The work on a new uniform standard commenced in July 2022, state Europe’s Rail and DG MOVE.

Criticism of the initiative

A few days after the publication of the “plan”, ZNPK, the association of small Polish operators, including LOTOS, METRANS, Polish branches of Captrain, Freightliner, etc., voiced criticism. It referred to other unions of Central European operators from Poland, Germany, Czechia, Hungary and Slovenia. According to ZNPK, so far, no long-enough tests of DACs under actual operating conditions have been carried out. These include loading and unloading works in extreme weather or dusty conditions. Limitations observed with cars of specific types like autoracks are also not taken into account. “Only the definition of a uniform standard and properly conducted tests would allow the complete assessment of the feasibility of replacing screw couplers used today with DAC”, ZNPK points out.

ZNPK emphasises the financial burden associated with future migration to DAC. According to the association, a coupler in basic configuration amounts between €15,000 and 20,000, which is several times higher than EY’s baseline estimates. ZNPK’s calculations show the DAC implementation could cost the industry €15–20 bln, car modernisation excluded. The association declares that operators need guaranteed financing and uniform procedures for approving the conversion to eliminate the risk of reducing the operational rolling stock.

The general director of ZNPK Michal Litwin explains, with costs so high, the need to modernise the entire rolling stock in such a short period threatens the competitiveness of rail transport. As operators are not capable of bearing heavy one-time costs without strong institutional support, these costs will be included in the rates their customers pay. Another representative of ZNPK, board member Miroslaw Szczelina believes only major operators can afford such costs, and it is them who will benefit. According to International Railway Journal, Deutsche Bahn is ready to equip its fleet with DAC. In 2022, DB Cargo, its subsidiary, had 63,000 freight cars. Meanwhile, smaller operators have insolvency risk, ZNPK emphasises.

Earlier, at Innotrans 2022, the possible lack of the EU’s funding to support the DAC implementation has been discussed. All the market players believe that the funding will be limited, and Czech operators estimate the actual costs even higher, up to €61 bln, according to DVZ, Germany.